The Rise of On-Demand Insurance: Is It Worth It?

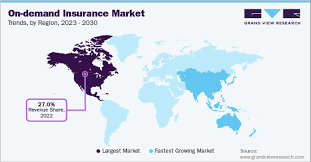

The Rise of On-Demand Insurance: Is It Worth It? In a world where convenience and instant access rule, it’s no surprise that insurance is going digital — and becoming more flexible than ever. Enter on-demand insurance, a fresh way to buy coverage exactly when you need it, for as long as you want. But is … Read more