The Rise of On-Demand Insurance: Is It Worth It?

In a world where convenience and instant access rule, it’s no surprise that insurance is going digital — and becoming more flexible than ever. Enter on-demand insurance, a fresh way to buy coverage exactly when you need it, for as long as you want.

But is this new insurance model just a gimmick, or is it genuinely worth your time and money? Let’s explore the rise of on-demand insurance and what it means for you.

What Is On-Demand Insurance?

On-demand insurance is a flexible, pay-as-you-go coverage model. Instead of committing to a year-long policy, you activate insurance only when you need it — sometimes by the hour, day, or week.

Examples include:

-

Insuring your rental car for a single trip

-

Covering a drone or expensive gadget only during use

-

Temporary health insurance for a short trip abroad

You can usually buy it via an app or website within minutes, making it perfect for spontaneous needs.

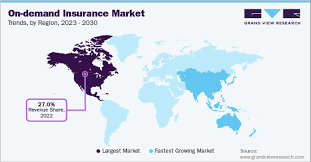

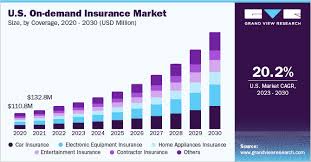

Why Is On-Demand Insurance Growing?

1. Changing Consumer Habits

People want control and flexibility, not long contracts. Millennials and Gen Z especially value:

-

Instant digital access

-

Customizable coverage

-

No long-term commitments

2. The Gig Economy

With more freelancers, rideshare drivers, and short-term workers, traditional insurance doesn’t always fit their unpredictable schedules.

3. Technology Advancements

Apps, AI, and digital wallets make it easy to buy, manage, and claim on insurance with a few taps.

Pros of On-Demand Insurance

✅ Flexibility

Only pay for what you use, when you need it. No overpaying for months when you don’t need coverage.

✅ Convenience

No paperwork, no phone calls — just quick purchases from your phone.

✅ Tailored Coverage

Get coverage for specific activities or items, reducing unnecessary costs.

Cons of On-Demand Insurance

❌ Cost Can Add Up

While cheaper short-term, frequent use can get expensive compared to traditional annual policies.

❌ Limited Coverage Types

Most on-demand options are for niche needs, like gadgets, travel, or rideshare. They don’t replace core policies like homeowners or comprehensive health insurance.

❌ Claims Process May Vary

Because it’s new, some providers have less established claims services, which can be frustrating.

Is On-Demand Insurance Right for You?

Consider on-demand insurance if you:

-

Rent cars or homes occasionally and want short-term coverage.

-

Use expensive gadgets, drones, or cameras infrequently.

-

Work in the gig economy with variable schedules.

-

Travel occasionally and want short-term travel insurance.

But if you need steady, ongoing protection (home, health, auto), traditional policies might still be better.

How to Get Started

-

Research providers with strong customer reviews.

-

Read the fine print to understand exactly what’s covered.

-

Compare prices vs. your existing policies.

-

Use it as a supplement, not a replacement, for essential insurance.

Final Thought

On-demand insurance is reshaping how we think about coverage — making it more flexible, accessible, and tech-friendly. It’s a smart choice for specific, short-term needs but isn’t yet a full substitute for traditional insurance.

As this market grows, expect more options and better pricing. For now, use on-demand insurance to fill gaps, not replace your core protection.